The ATO has reminded SMSF trustees that the COVID-19 relief and support offered to SMSFs ended on 30 June 2022.

At the peak of the COVID-19 pandemic, SMSF trustees that were financially or otherwise impacted by the recurring and prolonged lockdown periods were granted relief by the ATO.

The relief was offered to SMSFs for the 2019/20, 2020/21 and 2021/22 financial years where certain situations beyond their control may have caused SMSF trustees to contravene superannuation law.

For example, an SMSF trustee may have given tenant/s (including a related party tenant) a reduction in rent if they were financially impacted due to COVID-19. As charging a price that is less than market value will usually give rise to contraventions under the superannuation laws, the relief measures avoided this outcome if the arrangement met certain criteria (ie. the relief was offered on commercial terms and the arrangement was documented, etc).

The relief measures that were available

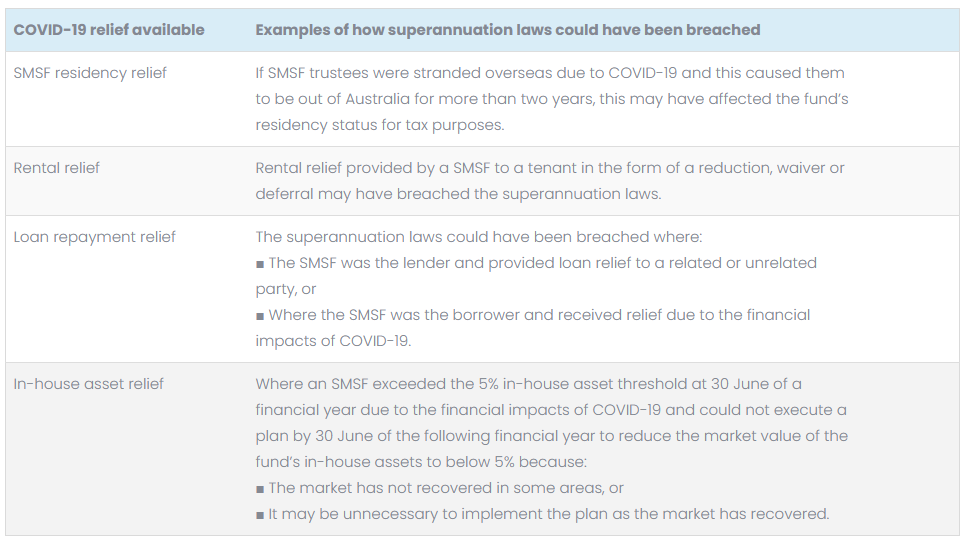

The table below shows the types of relief SMSF trustees were offered by the ATO.

Actions required for SMSF trustees

As the ATO’s COVID-19 support has ended, the ATO expects:

- SMSF trustees to now comply with their obligations under the income tax and superannuation laws previously covered by the relief

- Approved SMSF auditors to report contraventions to the ATO via the Auditor/actuary contravention report (ACR) where the reporting criteria is met.

The ATO has also reminded SMSF trustees to ensure they document any relief they accessed and to provide their approved SMSF auditor with evidence to support their case for the purposes of their annual SMSF audit. SMSF trustees have also been encouraged to take advantage of the ATO voluntary disclosure service and formulate a plan of rectification should any contraventions occur.

Please contact the TNR team if you have any queries regarding COVID-19 relief for SMSF trustees.

Important: The information contained in this post / article is not advice. Readers should not act solely on the basis of material contained in this post. Items herein are general comments only and do not constitute or convey advice per se. We recommend that our formal advice be sought before acting on anything contained in this post.